As an entrepreneur, exploring the perplexing universe of duties and costs can be an overwhelming undertaking. In any case, one system that can essentially affect your primary concern is successfully discounting operational expense. By understanding the subtleties of this training, you can limit your duty responsibility and amplify your benefits. In this thorough aide, we’ll dig into the specialty of discounting operational expense, furnishing you with important bits of knowledge and viable tips to assist you with capitalizing on your derivations.

- Understanding Costs of doing business

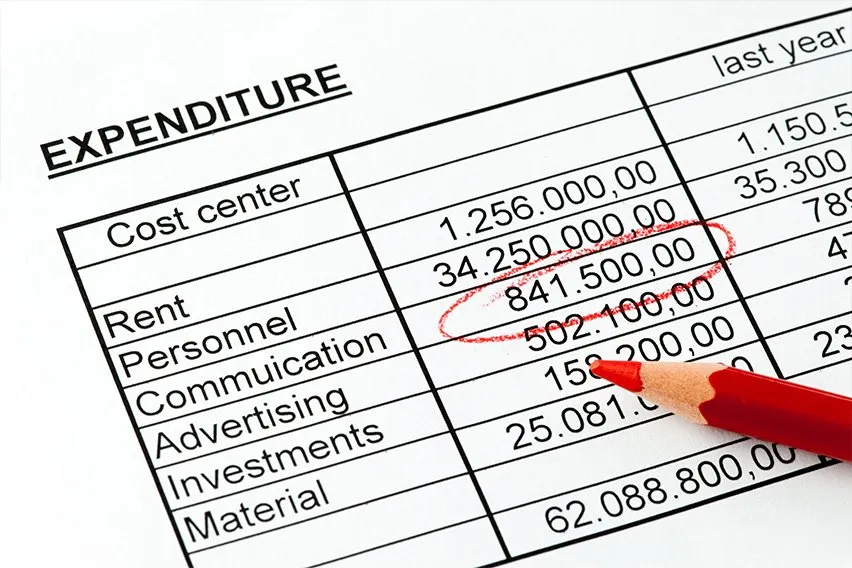

Prior to jumping into the points of interest of discounting costs, it’s pivotal to have a strong handle of what is a real operational expense. Basically, an operational expense is any expense that is essential and normal for your exchange or calling. This can incorporate many consumptions, including office supplies, lease, utilities, travel, advertising, and worker compensation. The key is to guarantee that these costs are straightforwardly connected with your business activities.

- Keep Precise Records

The foundation of fruitful cost put down offs is careful account keeping. Keep an orderly record of all your deals, including receipts, solicitations, and budget reports. Cloud-based bookkeeping programming can be tremendously useful in sorting out and classifying your costs, making it more straightforward to distinguish potential derivations come charge time.

- Sort Costs Appropriately

Appropriately sorting your costs is fundamental for precise expense detailing. The Inward Income Administration (IRS) has explicit classes for costs of doing business, like promoting, travel, feasts, and utilities. Dole out each cost to its separate classification to smooth out the derivation interaction and stay away from likely inconsistencies during reviews.

- Separating Among Individual and Operational expense

One normal trap for entrepreneurs is mixing individual and costs of doing business. It’s critical to keep an unmistakable qualification between the two to guarantee that main real business costs are asserted as derivations. This shields your funds as well as forestalls possible lawful difficulties.

- Figure out Deductible versus Non-Deductible Costs

Not all costs are made equivalent according to the IRS. While deductible costs decrease your available pay, non-deductible costs can’t be utilized to counterbalance your duty responsibility. For example, individual costs, fines, and political commitments by and large don’t qualify as deductible operational expense. Find out more about the IRS rules to try not to erroneously guarantee non-deductible costs.

- Work space Allowance

In the event that you work your business from a work space, you might be qualified for a work space derivation. This derivation permits you to discount a part of your lease or home loan, utilities, and other home-related costs corresponding to the space utilized only for your business. Guarantee that you meet the IRS necessities for asserting this derivation to stay away from likely warnings.

- Travel and Amusement Costs

Travel and amusement costs can be critical for organizations, particularly those that require continuous client gatherings or industry occasions. While reporting these costs, keep up with itemized records, including the motivation behind the cost, the people in question, and the business relationship. The IRS has explicit standards with respect to the allowance of movement and diversion costs, so it’s vital to intently stick to them.

- Dinners and Amusement Derivations

While the IRS has made changes to dinner and diversion derivations as of late, discounting a part of these expenses is as yet conceivable. Business-related feasts are for the most part deductible at a pace of half, if they are straightforwardly connected with your business exercises. To keep away from expected issues, guarantee that you keep up with appropriate documentation, remembering receipts and notes for the reason for the dinner.

- Vehicle Costs

Assuming that your business requires huge travel, you might be qualified for vehicle cost allowances. The IRS offers two essential strategies for working out these allowances: the standard mileage rate and the real cost technique. The standard mileage rate permits you to deduct a limited sum for every business mile driven, while the genuine cost technique includes deducting the real expenses related with working the vehicle, like fuel, upkeep, and devaluation. Pick the technique that best suits your business needs and keep up with precise records of your mileage and costs.

- Counsel a Duty Proficient

Exploring the complexities of cost of doing business discounts can be testing, particularly as expense regulations develop. To guarantee that you’re capitalizing on your derivations while remaining consistent with current guidelines, consider counseling a certified expense proficient. A bookkeeper or duty counsel can give customized direction in view of your business’ remarkable conditions, possibly uncovering extra derivations you could have ignored.

End

Excelling at discounting costs of doing business is an expertise that can essentially influence your monetary accomplishment as an entrepreneur. By figuring out the subtleties of deductible costs, keeping up with precise records, and complying to IRS rules, you can bridle the force of authentic allowances to limit your assessment obligation and amplify your benefits. Keep in mind, remaining informed and looking for proficient exhortation when required are key stages on your excursion to turning into a sagacious and charge productive business person.

The post How to write off business expenses appeared first on TechStory.

0 comments:

Post a Comment