That is a lot of money...

What you need to know

- One analyst has just upgraded Apple's stock rating from 'neutral' to 'buy'.

- David Vogt of UBS says Apple Car could be worth at least $14 per share.

- Vogt also estimates Apple will ship 220M iPhones in 2021.

A new report says that analyst David Vogt of UBS has updated his Apple stock rating from 'neutral' to 'buy' and says that a rumored Apple Car could be worth at least $14 per share to the company.

From Seeking Alpha:

Telling investors to "bite the big Apple", UBS upgrades the iPhone maker from Neutral to Buy and raises the price target from $115 to $142.

Vogt's upgraded target price comes in part from "stable long-term" demand for the iPhone 12 and beyond, as well as higher average selling prices and Apple's rumored foray into the world of cars, the latter of which is based on ever-increasing rumors Apple wants to release a self-driving electric vehicle.

Speaking about Apple Car, Vogt says that "Apple's auto optionality is worth at least an incremental $14/share", an 11.7% increase on Apple's current share price of $119.90 and 9% on Vogt's target price of $142. $14/share would represent roughly a $230+ billion increase in Apple's market capitalization.

According to the report, Vogt has also revised his 2021 iPhone shipment estimations up by 5M to 220M, citing higher 5G demand in China. He also raised his FY22 revenue and earnings-per-share estimates by 4% and 7% respectively "based on those higher phone sales and stronger average selling prices" of the iPhone 13.

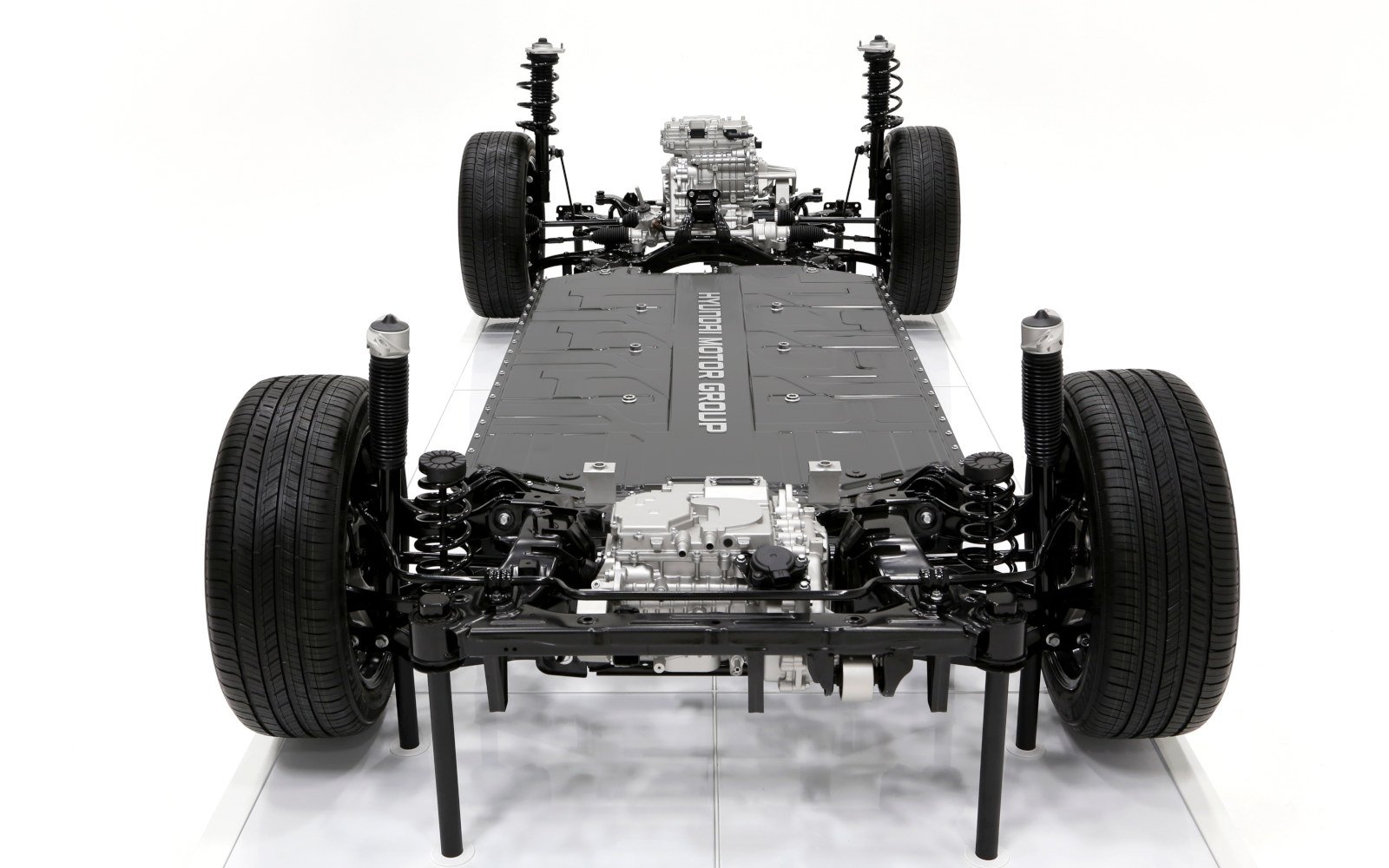

Many years away, Apple is rumored to be working on a self-driving electric vehicle that could cost more than a Tesla and might be based on Hyundai's E-GMP platform. Multiple analysts and insiders say an Apple Car is at least five years away.

0 comments:

Post a Comment